House Price Inflation May Hit Double-Digit Levels in 2017

Irish house price inflation is set to accelerate in 2017, potentially reaching double-digit levels, according to the MyHome.ie property report for the final quarter of 2016.

“Clearly low stock levels will be the main driver of what’s happening in the market and will be for the foreseeable future,” MyHome.ie Managing Director Angela Keegan said. “Our report is forecasting house price inflation of 8%, driven by that ever tightening supply and the economic recovery. However the report also highlights the impact of public policy on the market and warns that there’s a real possibility of double digit house price inflation.”

The report showed a “subdued end” for the Irish housing market in 2016 compared to earlier years which saw end-of-year activity artificially inflated by expiring tax reliefs or fears of a credit crunch ahead of the introduction of the Central Bank of Ireland’s lending rules.

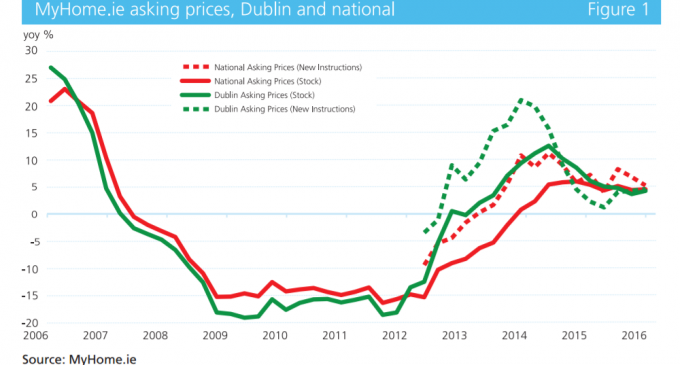

Prices on residential properties newly listed on the MyHome website were down 2.2% on the quarter, in line with normal seasonal patterns, but are up 5.5% on the year. Residential property prices grew by 7.1% in the year to October. The average time to sale agreed has now fallen to just four months nationally and three months in Dublin.

“A tight housing market may help house price inflation, but transaction and mortgage lending volumes are being held back by the lack of housing supply,” Said Davy Research Chief Economist Conall MacCoille. “More broadly, a poorly functioning housing market will also hurt Ireland’s competitiveness and is becoming a growing constraint on the economy’s potential to attract foreign direct investment.”

“Ireland’s strong economic recovery, robust jobs growth and an ever-tightening housing market, especially in Dublin, were already likely to deliver substantial house price gains in 2017. However, public policy will, on two fronts, help to further stimulate house price inflation in 2017.

“First, the Help-to-Buy scheme – providing a tax rebate worth 5% of the purchase price of newly-built homes to first-time buyers – will add fuel to the fire. In the short term, the measure is likely to push up house prices, helping builders’ profit margins. However, there is likely to be little material impact on housing supply as land prices are quickly increased.

“Second, the Central Bank of Ireland has relaxed its lending rules so that there are no restrictions on the availability of 90% loan-to-value (LTV) mortgages to first-time buyers. Greater numbers of mover-purchasers will now be allowed to take out mortgages in excess of an 80% LTV. The immediate impact of the change is likely to be small, limited to Dublin and commuter belt counties which account for the bulk of transactions above the €220,000 threshold to which the rules applied. However, the main impact may be on expectations. As the housing market tightens, first-time buyers desperate to secure homes will be encouraged to take out the maximum 90% LTV loans.

“The most likely outcome is that Irish house price inflation should accelerate in 2017. We expect house price inflation to equal 8% through the calendar year. However, the combined impact of the Help-to-Buy scheme and looser lending rules means that double-digit house price inflation in 2017 is a distinct possibility.”

Asking Prices up 5% up the year

According to the latest MyHome data, the mix-adjusted price on the entire stock of homes available for sale rose by 0.1% in Q4 2016, up 4.8% on the year. The mix-adjusted price on properties newly-listed properties on the MyHome.ie website fell by 2.2% in Q4 2016. However, this may be a seasonal effect, with asking prices falling in the final quarter of every year for the last four years. Prices on newly listed properties are still up 5.5% on the year.

The CSO’s Residential Property Price Index (RPPI) shows that Irish residential prices increased sharply through the summer months. The RPPI rose by 2.4% in July, 1.4% in August, 1.5% in September and 0.8% in October.

These are frothy price gains consistent with double-digit inflation, running at 7.1% in October. In Dublin, house price inflation accelerated from a low of 2.0% in June to 6.1% in October. Outside Dublin, prices are still catching up, up 10.3% on the year, with the sharpest gains in the Midlands (+16.6%), the South East (+13.7%) and the West (+13.0%).

Lack of housing supply puts brake on transactions

The MyHome data for the final quarter of 2016 show the Irish housing market grinding ever tighter. The number of properties listed for sale has fallen again to a fresh low. In Q4 2016, there were just 20,875 properties listed for sale on the MyHome website – down 7.7% on last year. This means that just 1% of the Irish housing stock is currently listed for sale.

The lack of liquidity is particularly acute in Dublin. There were 3,619 properties listed for sale in Dublin, down 19.9% on last year. This means just 0.7% of Dublin’s housing stock of 535,000 properties is currently listed for sale. In this context, buyers are becoming ever more desperate to secure properties.

In Q4 2016, the average time to sale agreed fell to a new low of four months across Ireland and to just three months in Dublin.

The lack of housing supply is clearly supporting house prices. However, transaction volumes look set to fall below last year’s total. In the first ten months of 2016, there were 38,750 residential transactions, down 1.9% on the same period of 2015. Transactions were especially weak in the first half of 2016 but appear to have rebounded in H2. So we still expect some pick-up in liquidity in 2017. However, the bigger picture is that Ireland’s housing market remains exceptionally illiquid.

The approximately 48,000 transactions in 2015 represented close to 2% of the housing stock, suggesting that the average house is sold just on*-ce every 50 years. Transaction rates in the UK are twice Ireland’s level at 4.3% of the housing stock.

Construction activity continues to pick up

A range of indicators on the construction sector suggest that activity is picking up quickly but from a very low base. Housing completions to October are up 17.8% on 2015 and look set to equal 15,000, up from 12,666 last year. In the year to September, planning permissions for 12,046 dwellings were granted, up 33% on 2015. Commencement notices are also up 38% on the year.

Other indicators also suggest that construction activity is recovering. The Quarterly National Household Survey (QNHS) shows that the construction sectoradded 9,000 jobs in the year to Q3 2016 with total employment in the sector up 7% to 137,000 – its highest level since 2009. Ireland’s Construction PMI was 59.8 in November, with housing activity (63.9) expanding more rapidly than the overall sector.

Despite signs that activity in residential construction is finally gearing up, homebuilding levels still remain below those seen in the 1970s.

The full report, including regional analysis, can be found here.