Construction Activity Declines at Fastest Pace Since June 2013

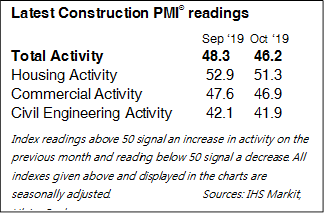

The Ulster Bank Construction Purchasing Managers’ Index® (PMI®) – a seasonally adjusted index designed to track changes in total construction activity – fell to 46.2 in October from 48.3 in September. The rate of contraction was solid and the most marked since June 2013.

Commenting on the survey, Simon Barry, Chief Economist Republic of Ireland at Ulster Bank, noted that: “The latest results of the Ulster Bank Construction PMI survey showed a further loss of momentum in Irish construction activity last month. A decline in the headline PMI index, from 48.3 in September to 46.2 in October, signalled a second consecutive monthly decline in activity. Meanwhile, the detail behind the headline reading also painted a disappointing picture, with weaker activity patterns reported across all three main subsectors. Commercial activity decreased for a second month running in October and, similarly to the headline index, the pace of contraction quickened to its fastest since June 2013. More encouragingly, housing activity continues to grow, with its PMI reading of 51.3 still above the expansion threshold of 50. Housing remained the strongest sub-sector for a 10th month in a row, though the pace of residential activity growth has also softened materially in recent months and currently stands at a 4½ year low.

“The New Orders index fell from 50.8 in September to 48.8 in October, with a reading below the 50 no-change benchmark signalling that new orders decreased last month for the first time since June 2013. Respondents linked this decline to Brexit uncertainty as anecdotes from the survey highlight that concerns about Brexit impacts continue to weigh on activity and sentiment regarding the sector’s prospects for the coming year. In this context, the recent easing of concerns regarding Brexit crashout risk may offer some support for construction confidence and activity in the months ahead.”

Only residential sees a rise in activity

For the second month in a row, housing was the only monitored sub-category to observe an increase in activity during October. The rate of reduction of commercial activity quickened from September and was the fastest since June 2013. Civil engineering activity, meanwhile, declined for the fourteenth consecutive month, and at a sharper pace than in September.

For the second month in a row, housing was the only monitored sub-category to observe an increase in activity during October. The rate of reduction of commercial activity quickened from September and was the fastest since June 2013. Civil engineering activity, meanwhile, declined for the fourteenth consecutive month, and at a sharper pace than in September.

First fall in new orders since June 2013

In line with the fall in activity, inflows of new business placed at Irish construction firms decreased in October for the first time since June 2013. Panellists commented that Brexit uncertainty at customers had contributed to the reduction in new business.

Employment growth remains weak

Despite decreases in activity and new orders, Irish construction firms added to their headcounts in October. That said, the rate of job creation was marginal and matched the almost six-year low recorded in September. Anecdotal evidence from panellists indicated that extra staff had been hired in line with investment activity.

Purchasing activity among Irish construction firms returned to growth in October. The rate of expansion was only slight, however. Anecdotal evidence from panellists indicated that they had raised their input purchases in order to mitigate any supply disruptions from Brexit.

On the price front, the rate of input cost inflation quickened to a three-month high and was sharp. Surveyed firms attributed the latest rise in cost burdens to higher raw material prices, with greater prices paid for steel, fuel and insulation.

Finally, optimism among Irish construction firms picked up from September to the highest in three months during October. Just over 31% of panellists expect activity to increase over the coming year. Positive sentiment was linked to forecasts of improving economic conditions and new capital investment.