Solid Rise in Construction Activity, But New Order Growth Slows to Four-and-a-half Year Low

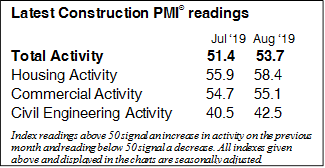

The Ulster Bank Construction Purchasing Managers’ Index® (PMI®) – a seasonally adjusted index designed to track changes in total construction activity – rose to 53.7 in August from 51.4 in July. This marked the first pick-up in the rate of growth in four months, with construction activity increasing at a solid pace midway through the third quarter.

Commenting on the survey, Simon Barry, Chief Economist Republic of Ireland at Ulster Bank, noted that: “Growth in Irish construction activity re-accelerated in August, according to the latest results of the Ulster Bank Construction PMI survey. The rate of overall expansion picked-up from July’s six-year low as the headline index rose from 51.4 in July to 53.7 in August, in the process halting a three-month sequence of deceleration. The improvement reflected better performance across the three main sub-sectors. A welcome re-acceleration in Housing activity saw it record the sharpest increase in activity, thus remaining the strongest performing category last month. Commercial activity also continued to grow solidly, with the Commercial PMI rising to a five-month high of 55.1 in August from 54.7 in July. Civil engineering remains an area of weakness, however, with respondents reporting a twelfth consecutive monthly fall in activity, albeit at a reduced pace in August.

“Overall, following the sharp weakening in the pace of construction activity recorded over the previous three months, the pick-up in the August PMI is an encouraging sign that construction growth regained some momentum as the sector completed its sixth year of recovery. However, there are also reasons to maintain a somewhat cautious view about the sector’s near-term prospects. New orders moderated further, with the August reading marking the slowest pace of new business growth in four and a half years. In turn, the ongoing cooling in order flows is underpinning slower – but still positive – growth in demand for construction workers, with the pace of job creation easing to a near six-year low in August. Moreover, confidence about the coming year fell sharply in August, leaving the Future Activity Index at its lowest level since 2010. The slippage in sentiment largely reflected worries about Brexit impacts, with some firms reporting that Brexit uncertainty is impacting work pipelines due to delayed decision-making among clients.”

“Overall, following the sharp weakening in the pace of construction activity recorded over the previous three months, the pick-up in the August PMI is an encouraging sign that construction growth regained some momentum as the sector completed its sixth year of recovery. However, there are also reasons to maintain a somewhat cautious view about the sector’s near-term prospects. New orders moderated further, with the August reading marking the slowest pace of new business growth in four and a half years. In turn, the ongoing cooling in order flows is underpinning slower – but still positive – growth in demand for construction workers, with the pace of job creation easing to a near six-year low in August. Moreover, confidence about the coming year fell sharply in August, leaving the Future Activity Index at its lowest level since 2010. The slippage in sentiment largely reflected worries about Brexit impacts, with some firms reporting that Brexit uncertainty is impacting work pipelines due to delayed decision-making among clients.”

Housing sector leads overall expansion

The housing category remained a key source of strength in August. Activity on residential projects expanded at a substantial pace, with the rate of growth rebounding from July. A marked increase in commercial activity was also recorded, while work on civil engineering projects fell at a softer pace.

Further slowdown in new order growth

Reflecting signs of a slowdown, the rate of growth in new orders softened to the weakest since February 2015. While some panellists indicated that underlying demand remained firm, others pointed to delayed decision making among customers.

Lowest sentiment since November 2010

Employment continued to rise, but the rate of job creation was only slight and the weakest since October 2013. While the pace at which input buying rose was sharper than that seen in July, it was still the second-weakest in five-and-a-half years.

Pressure on supply chains was also shown to be less marked in August. Despite lengthening on the back of higher purchasing activity, delivery times increased to the least extent since November 2017.

August saw a sharp slowdown in the pace of input cost inflation for Irish construction firms, with anecdotal evidence linking this to weakness of sterling against the euro making imported items cheaper. The pace at which input costs rose was the slowest in 64 months, but remained solid amid reports of higher prices charged by suppliers for items such as insulation.

The potential impact of Brexit on the Irish construction sector contributed to a sharp drop in confidence regarding the 12-month outlook for activity. Sentiment was only just in positive territory, and the lowest since November 2010. Those companies that expect activity to increase over the coming year put this down to planned new projects and predictions of an improvement in demand in the sector.